On January 25th, 2022, the U.S. House of Representatives released competitiveness legislation called the America Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength (America COMPETES) Act of 2022.

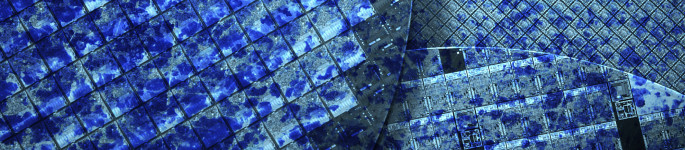

The legislation includes $52 billion to fund the semiconductor research, design, and manufacturing provisions in the CHIPS for America Act. The Senate passed funding for the CHIPS Act as part of the bipartisan United States Competition and Innovation Act (USICA) in June 2021.

A semiconductor investment tax credit, as called for by the FABS Act, complements the manufacturing incentives and research investments in the CHIPS Act. Congress is considering separate legislation containing a modified version of the FABS Act to provide an investment tax credit to incentivize semiconductor manufacturing in the U.S.

Recognizing the critical role semiconductors play in America’s future, Congress in January enacted the CHIPS for America Act as part of the FY 2021 National Defense Authorization Act (NDAA). The law authorized incentives for domestic semiconductor manufacturing and investments in chip research, but funding must be provided to make these provisions a reality. Funding the CHIPS Act, along with enactment of a strengthened FABS Act, are complementary efforts and will help enhance the global competitiveness of the U.S. semiconductor industry.

ATREG applauds all the measures that the U.S. Administration is taking to support its domestic semiconductor industry.