SOLD: ELMOS OPERATIONAL 200MM FAB, DORTMUND, GERMANY

ATREG is pleased to announce that it has successfully advised Elmos Semiconductor SE on the disposition of its operational automotive-certified 200mm manufacturing facility located in Dortmund, Germany. Elmos has entered into a definitive sale and purchase agreement with Silex Microsystems AB, a pure-play MEMS foundry headquartered in Järfälla, Sweden, for a net purchase price of €77.5 million plus around €7 million for the work-in-progress inventory, totaling approx. €85 million. The transaction is expected to close in the second half of 2022, subject to customary closing conditions and regulatory approvals. The transaction includes a long-term supply agreement until at least 2027, with Elmos buying processed wafers produced at the fab.

“This transaction is an important structural alignment of our manufacturing strategy. And it provides a long-term perspective with new products and technologies for the Dortmund wafer fab and its employees,” explains Elmos CEO Dr. Arne Schneider. “The ATREG team has been instrumental at bringing the right caliber of global buyers to the table and demonstrated the creativity needed in structuring a transaction model that met all of our business objectives.”

“Global demand for 200mm fab assets has been at an all-time high this year and we expect it to show no abatement in 2022,” adds Stephen Rothrock, president and CEO of ATREG. “The unique structure of this transaction is a win-win for Elmos and Silex. We are very pleased with the outcome for both parties.”

Click here to read our full press release.

Click here to read Elmos’ press release. Click here to read Silex Microsystems’ press release.

EXECUTIVE Q&A: JOHN NEUFFER, PRESIDENT & CEO, SIA

ATREG recently sat down with John Neuffer, President and CEO of the Semiconductor Industry Association (SIA) headquartered in Washington D.C., to discuss U.S. federal investments in domestic chip production so far and what the industry can expect in terms of support from U.S. policy in 2022.

ATREG recently sat down with John Neuffer, President and CEO of the Semiconductor Industry Association (SIA) headquartered in Washington D.C., to discuss U.S. federal investments in domestic chip production so far and what the industry can expect in terms of support from U.S. policy in 2022.

What has happened over the last couple of years to motivate U.S. policymakers to take action in support of domestic semiconductor research, design, and manufacturing?

A confluence of factors has highlighted the urgent need for U.S. government investments in domestic semiconductor production and innovation. First, the shortage of personal protective equipment (PPE) and ventilators early in the pandemic spurred a greater awareness of supply chain vulnerabilities for other critical products, including semiconductors. Second, the global chip shortage has broadened concerns about chip supply chain vulnerabilities. And third, ongoing U.S.-China tensions have led to efforts in Washington to reinforce U.S. technological competitiveness, including in semiconductors, which are essential to America’s economy, national security, and critical infrastructure.

What kind of impact would federal investments in domestic chip production have on the U.S. economy?

What kind of impact would federal investments in domestic chip production have on the U.S. economy?

An SIA / Boston Consulting Group report found that with a $50 billion federal investment in domestic manufacturing incentives, there would be 19 new fabs built in the U.S. over the next 10 years (10 more than would be built otherwise), and such an investment would generate about $280 billion in semiconductor industry spending. A separate SIA / Oxford Economics study projects such a federal investment program would create an average of 185,000 temporary American jobs annually and add $24.6 billion yearly to the U.S. economy as new semiconductor fabs are built from 2021 to 2026. Such federal investments would also add 280,000 permanent jobs to the U.S. economy beyond 2026, including 42,000 direct semiconductor industry jobs. In addition, an SIA / Nathan Associates report found federal investments in semiconductor research offer a good ROI; each additional dollar invested adds $16.50 to U.S. GDP.

SIA has advocated for both the CHIPS Act, which would provide federal investments in domestic chip manufacturing and research, and the FABS Act, which would provide a semiconductor investment tax credit. Why are both these policies important?

The CHIPS Act and the FABS Act supplement each other and both are needed to strengthen the competitiveness of the U.S. semiconductor industry. The CHIPS Act would quickly jumpstart U.S.-based semiconductor production and innovation by providing one-time, upfront grants for semiconductor fabrication and research investments. An investment tax credit, as called for in the FABS Act, would provide ongoing incentives for domestic chip manufacturing, fab upgrades, and equipment. Together, these two incentives would make the U.S. a competitive destination for increased investment in the semiconductor industry. We believe the FABS Act should be expanded to cover semiconductor design expenses, in addition to semiconductor manufacturing expenses.

What do you make of the recent announcements by several semiconductor companies of plans to build new fabs in the U.S. or expand existing ones?

What do you make of the recent announcements by several semiconductor companies of plans to build new fabs in the U.S. or expand existing ones?

We see the announcements of major semiconductor manufacturing investments as a sign that chip companies believe the U.S. government is serious about making America a more competitive place to locate chip production. Now it’s incumbent upon the U.S. government to get the CHIPS Act and an expanded FABS Act across the finish line, so more of the semiconductors our country needs are researched, designed, and manufactured on U.S. shores.

What should we expect in 2022 when it comes to the global chip shortage and U.S. policy?

Industry leaders have been working around the clock to address the global chip shortage. In fact, by the end of 2021, we will have shipped more units to our customers than during any other year in history, and we expect to set yet another record in chips shipped in 2022. All of this will, we believe, land us in a much better place next year when it comes to resolving the shortage issues. To help address the longer-term problem, we believe government should focus its efforts on ensuring the strength and resilience of America’s chip supply chains by funding the CHIPS Act and enacting a strengthened FABS Act. There is broad, bipartisan support for strengthening domestic semiconductor research, design, and manufacturing, so America’s chip supply chains are stronger for the future. Those backing funding for the CHIPS Act include many CEOs and other business leaders (including semiconductor industry leaders), U.S. governors, members of Congress, national security experts, and others. Given this strong support, we are optimistic leaders in Washington will fund the CHIPS Act and enact the FABS Act in early 2022 to shore up U.S. chip supply chains for many years to come.

About John Neuffer

John Neuffer has been President and CEO of the Semiconductor Industry Association (SIA) in Washington, DC since 2015. He is responsible for leading the association’s public policy agenda and serving as the primary advocate for maintaining U.S. leadership in semiconductor design, manufacturing, and research. Prior to SIA, John served for seven years as SVP for Global Policy at the Information Technology Industry Council. For the previous two years, he was Deputy Assistant U.S. Trade Representative for Asia-Pacific Economic Cooperation (APEC), preceded by five years as Deputy Assistant U.S. Trade Representative for Japan. For nine years before his government service, John was a Senior Research Fellow and Political Analyst with Mitsui Kaijyo Research Institute in Tokyo where he was a leading commentator on Japanese politics and policy.

John Neuffer has been President and CEO of the Semiconductor Industry Association (SIA) in Washington, DC since 2015. He is responsible for leading the association’s public policy agenda and serving as the primary advocate for maintaining U.S. leadership in semiconductor design, manufacturing, and research. Prior to SIA, John served for seven years as SVP for Global Policy at the Information Technology Industry Council. For the previous two years, he was Deputy Assistant U.S. Trade Representative for Asia-Pacific Economic Cooperation (APEC), preceded by five years as Deputy Assistant U.S. Trade Representative for Japan. For nine years before his government service, John was a Senior Research Fellow and Political Analyst with Mitsui Kaijyo Research Institute in Tokyo where he was a leading commentator on Japanese politics and policy.

As 2021 comes to a close, ATREG wishes you and yours a healthy and festive holiday season! Our team is very grateful and thankful for the continued loyalty and support of our valued clients and partners. This year again for the holidays, we will be making donations on their behalf to the following local and international non-profit organizations:

World Health Organization – More than 7,000 people working to lead and coordinate the global effort to prevent, detect, and respond to the global COVID-19 pandemic.

World Health Organization – More than 7,000 people working to lead and coordinate the global effort to prevent, detect, and respond to the global COVID-19 pandemic.- The Homeless Project / The Society of St. Vincent De Paul – Leading individuals who join together to offer person-to-person service to the poor and the suffering for the past 180 years.

- L’Arche International – An international federation dedicated to the creation and growth of homes, programs, and support networks for people with and without intellectual disabilities to live mutual relationships, share daily life, and build a community together.

- Global Partnerships – An international impact investor with the mission to expand opportunity for people living in poverty via micro-financing.

Wishing you and yours health, happiness, and success in 2022!

The ATREG Team

2021 GLOBAL FAB TRANSACTION RECAP: THE NEW NORMAL

This past year has yet again proven the continued resilience and endurance of the global semiconductor industry. To mitigate the global chip shortage left in the wake of the world’s COVID pandemic, semiconductor manufacturers have left no stone unturned to find ways to increase capacity and soften the blow on production disruption in the many industries relying on electronic components. In the space of just five short years, the fab buyers’ market we got accustomed to suddenly morphed into a fab sellers’ market, and as a result, a larger than usual number of announced or closed worldwide in 2021 (nine total).

The reasons for this comeback can be summarized in a few words – tight supply constraints, risks associated with a tense geopolitical environment, companies put on allocation (especially SMEs), and steady rises in prices. Sitting in the front row of the global fab transaction market for the past 22 years, ATREG’s President and CEO Stephen Rothrock was invited to share some of these market insights during SEMICON Europa’s Fab Management Forum held in Munich, Germany last month.

Front-end fabs

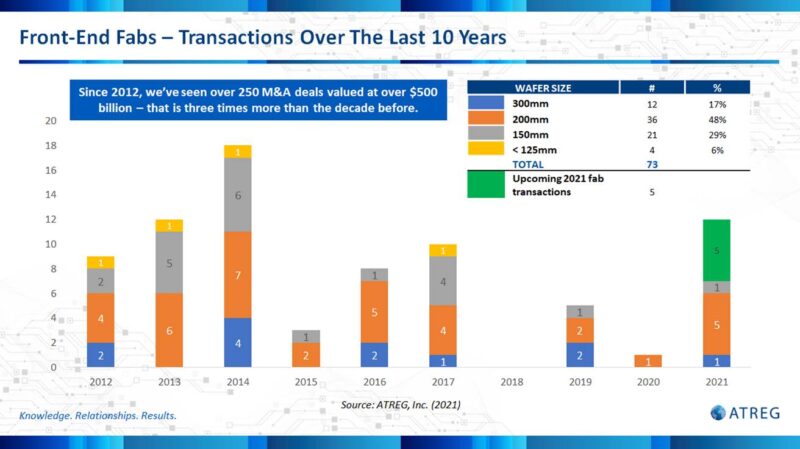

As you can see from Graph 1, the number of high-volume front-end fabs is not huge with only 73 total (not including the five fab transactions happening in 2021). There has been a surge in fab deals after the 2008-2010 recession followed by a significant tapering off from 2015 to 2020 with an average of 4.5 fabs sold per year. Consolidation was a major factor contributing to this low number due to some 250 M&A deals made over a 12-year period and valued at over $500 billion, nearly three times the amount of the previous 12 years. Thirty-six 200m fabs were sold and in 2021, that trend continued with five, four of which are 200mm. The largest transaction that took place in 2021 which was facilitated by ATREG was Texas Instruments’ acquisition of Micron’s operational 300mm fab located in Lehi, UT. The deal included the transfer of the fab’s entire local workforce (1,215 employees), a major asset in and of themselves in today’s tight labor market.

Graph 1 (source: ATREG, Inc., 2021)

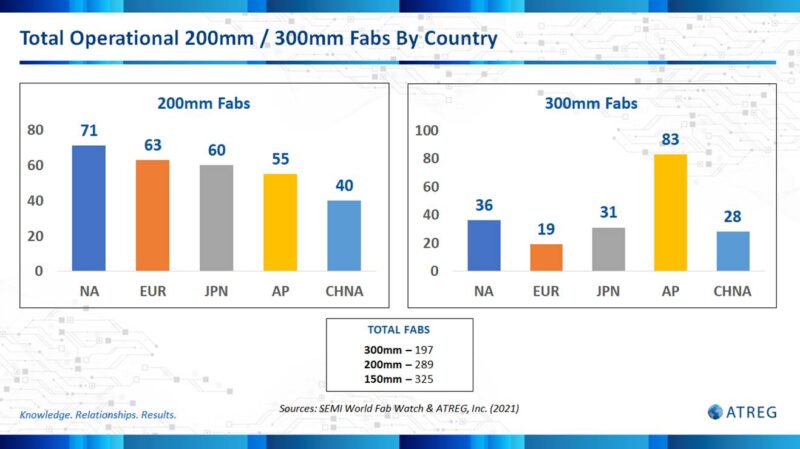

Now, if we look at the fab breakdown by country or region in Graph 2, what does it tell us about how we can solve the global fab shortage? Existing fabs are running at over 100% capacity and tools are constrained. Many 200mm users are buying 300mm fabs to then calibrate them back to 90nm, .13, and .18 nodes. Fabs such as the former Qimonda 300mm shell in Richmond, VA being represented by ATREG are entertaining visits to restart. Companies such as Jacobs, Exyte, and Hoffman are evaluating how they can renovate, reengineer, and build fabs faster than ever before.

Compound semiconductor, GaN, GaA, SiC, and MEMS users need and want fabs, so is greenfield the answer to all of our problems? BOSCH thought so and kept it home in Germany with a build in Dresden. Across the pond, Wolfspeed (formerly Cree) is putting the finishing touches to the world’s largest greenfield silicon carbide device manufacturing facility at the Marcy Nanocenter near Utica in Upstate New York / Mohawk Valley, with the help of a $515 million incentive package from the state of New York. In the southern U.S., Intel, TSMC, and Samsung are planning or have broken ground on greenfield fabs in Arizona and Texas.

The large majority of all new fab projects between 2019 and 2020 were 300mm. The U.S. and Europe hold most 200mm fabs, but Asia-Pacific, Taiwan, and China combined hold 50% more 300mm fabs than the U.S. and Europe put together – 111 vs. 55. More 300mm tools are available than 200mm right now. So will we see the day when the U.S. can build fabs as fast as Taiwan when we know we are about 7 to 8 months behind? Only time will tell.

Graph 2 (sources: SEMI World Fab Watch & ATREG, Inc., 2021)

Back-end fabs

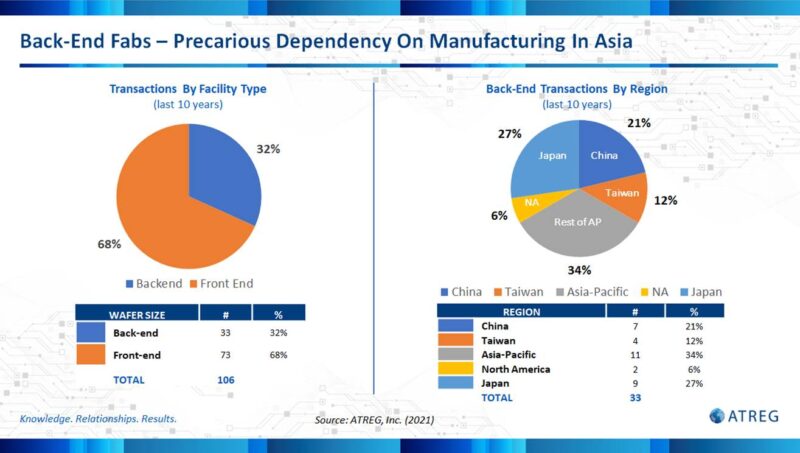

Now let’s focus our attention on what’s happening on the global back-end scene where that eastern dominance is more pronounced. Graph 3 shows that 6% of total back-end transactions happened in North America over the last 10 years. The chart on the left highlights the proportion of front-end vs. back-end fab transactions over the same period, 68% vs. 32% respectively. So far this year, three back-end transactions have taken place:

- The sale of Allegro MicroSystems’ Thai cleanroom to InnoLight facilitated by ATREG

- The acquisition by VIS of AUO’s Hsinchu, Taiwan fab

- SkyWater Technology Foundry’s acquisition of the former 200mm BRIDG cleanroom in Osceola, FL

Taiwanese OSATs are expected to sustain tight capacity supply for packaging services, chip probing, and final test operations through 2022, largely from international IC designers and automotive chip IDMs, with products boosting demand such as automotive CMOS image sensors, automotive MCUs, wireless communication chips, SiC and GaN power chips, as well as RF modules. Chinese OSATs are also seeing full capacity utilizations and order visibility through the end of 2021.

Graph 3 (source: ATREG, Inc., 2021)

Greenfield fabs: The new normal?

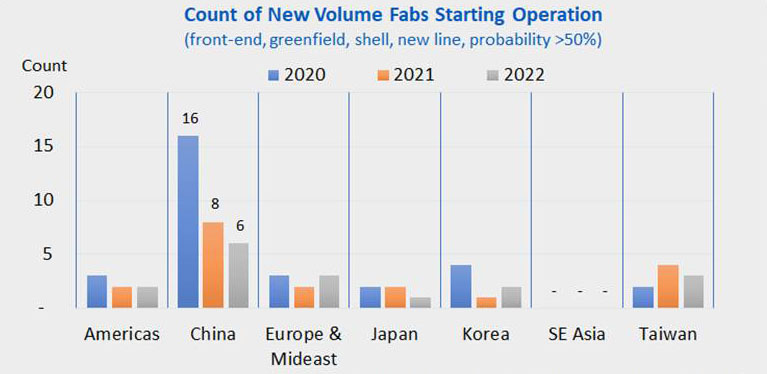

Out of 66 new fabs built between 2020 and 2022, 30 or 45% have been / are being built in China. An additional 49 fabs are expected to come online in 2023 / 2024. Opening a fab in the U.S. or Europe used to affect only one small part of the manufacturing process. Today, with the localization craze driven by politics rather than science or business, semiconductors are often designed in the U.S. or Europe, tested and assembled in SE Asia, fabricated in Taiwan or South Korea, and installed into products in China. The semiconductor industry is a highly specialized and interdependent ecosystem. If one country fails, the whole group fails! Greenfield may be an attractive answer to the global chip shortage, but at a phenomenal price tag, not to mention the many impediments still present, including entitlements such as certification as well as the lack of qualified construction workers in certain regions.

Graph 4 (source: SEMI’s World Fab Forecast Report, 1Q21 update)

2021: The turning point for fab demand

This year was a true turning point from a fab market demand perspective. By December 31st, a total of five fabs will have changed hands. To illustrate this new normal, here are some real-world statistics showing how global demand for fab assets has risen this year and the reasons behind it:

- 200mm demand is driven by the fear of allocation and desire for internal manufacturing control.

- Compound and specialty fabs (SiC, GaN, GaAs, MEMS) with convertibility to 200mm are extending the lifecycle of and increasing demand for 150mm fabs.

- The operational brownfield fab shortage is expected to continue through to at least mid-2025 and disrupted domestic supply chains are delaying future greenfield fab production.

- The shortage of 200mm tools shows no abatement.

- IDMs want to bring processes back in house to protect their IP as well as mitigate allocation and de-risk.

- The shortage of skilled construction workers will continue throughout the industry; competing projects limit availability for all.

Key takeaways

The new normal: Government interest / interference

The new normal: Government interest / interference

Global government incentives are a game changer. Over the next five years, local government incentives will impact fab economics and influence the location of future fab construction.

- Europe – Adoption of Horizon Europe Work Program and IPCEI incentives; Special interest in Germany (Intel, TSMC, Apple’s Silicon Design Center with a planned investment of more than €1 billion)

- USA – Most attractive U.S. government incentives located where there is the heaviest concentration of semiconductor manufacturing

- China – Continuously missing internal fab construction targets; Lack of focusing efforts in one region; Farming off to multiple provinces is diluting efforts

Chips are the new oil / more innovative deal structures emerging

With the continued global shortage of operational brownfield fabs, manufacturers are taking the future of their supply chain into their own hands. Here are some concrete examples:

- Greenfield government incentives are driving the build-out of state-of-the-art fabs (eg. TSMC in AZ and Wolfspeed in NY)

- Brownfield fab demand is at an all-time high, including their workforce (eg. TI / Micron Lehi UT deal)

- More and more creative fab collaboration models are emerging (eg. STMicroelectronics and Tower sharing a fab in Italy or TSMC / Sony joint-venture in Japan)

Wolfspeed’s state-of-the-art greenfield SiC fab in Mohawk Valley, New York

We’ll see more fabs from specialty product manufacturers

Compound semiconductor, MEMS, and advanced packaging companies are currently seeking mid-tier fabs and they’ll decide to go for greenfield if they can’t find adequate available brownfield facilities on the market.

- New technologies give regions opportunities to establish themselves as global leaders, e.g. BOSCH and the Transform project collaborating to establish a European-based supply chain for silicon carbide.

- Not every company requires or can afford to build megafabs. Mid- and small-scale fabs have a critical place in the supply chain, particularly for newer technologies.

- Governments are focused on incentivizing large-scale expansions, but incentives should be made available to specialty entities as well.

- Creative manufacturing models also exist in specialty manufacturing, eg. ROHM sharing an SiC fab with Zhenghai Semiconductor in Shanghai, China.

So where do we go from here?

What do we need? What should we expect from the global manufacturing asset market going into 2022 and beyond? What is certain is that we are going to have an unprecedented year again. Having said that, many challenges still lie ahead:

- Semiconductors are foundational and supply chain constraints must be addressed – we must recognize the global interdependence of our global ecosystem. Qualified technical talent is lacking and there are still too many outages (water, power, transportation).

- Customer / supplier relationships are more critical than ever before – we must proactively address the complexities of our industry and our geo-political environment to succeed.

- We need overarching pan-European and pan-American manufacturing strategies – to ensure Europe and the U.S. retain their semiconductor leadership.

- We need to find balance between financial performance and holding onto our fabs – between the Street’s push for financial performance and the need to establish more hold on our manufacturing assets.

- New sources of capital are needed – to migrate more foundry capability over to the next generation.

- We need to take a page out of Taiwan’s book – learn how to build new fabs faster and smarter to mitigate our precarious dependency on Asia.

Should you wish to discuss your manufacturing asset acquisition or disposition needs for 2022 and beyond, please contact us to set up an appointment with a member of our team.

SEE YOU AT ISS 2022 IN HALF MOON BAY

ATREG will attend SEMI’s annual Industry Strategy Symposium (ISS) to be held from January 9 to 12 in Half Moon Bay, Calif.

ATREG will attend SEMI’s annual Industry Strategy Symposium (ISS) to be held from January 9 to 12 in Half Moon Bay, Calif.

Need to dispose of or acquire a brownfield fab or cleanroom? Looking for a brand-new greenfield building location or extra loading capacity? ATREG can help! Please email us to set up an appointment with a member of our team at the event to discuss your infrastructure-rich manufacturing asset needs. We look forward to seeing you there!

Click here to register for the event.