ATREG REPRESENTS ELMOS IN SALE OF 200MM DORTMUND FAB TO LITTELFUSE

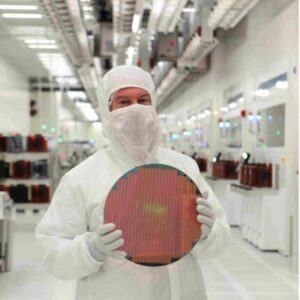

ATREG is pleased to announce that it has successfully advised Elmos Semiconductor SE on the sale of its 200mm wafer fab located in Dortmund, Germany to Littelfuse, Inc., a $2.5 billion revenue industrial technology manufacturing company headquartered in Chicago, Illinois. Elmos has entered into a definitive agreement with Littelfuse for a total purchase price of approximately €93 million for the Dortmund wafer fab. In addition, Elmos and Littelfuse have agreed to enter into a defined multi-year capacity sharing arrangement with an initial term lasting through 2029, with Elmos buying defined volumes of wafers produced at the fab.

“The ATREG team has been instrumental in bringing the right caliber of global buyers to the table and demonstrated the persistence needed in achieving a transaction that met all of our business objectives,” explains Elmos CEO Dr. Arne Schneider. “The sale of this wafer fab is an important structural alignment to our strategy, and over time, also brings new products and technologies to the Dortmund wafer fab and its workforce. We greatly appreciate ATREG’s long-term partnership and strong industry relationships that have enabled us to get to this successful outcome with Littelfuse.”

“The ATREG team has been instrumental in bringing the right caliber of global buyers to the table and demonstrated the persistence needed in achieving a transaction that met all of our business objectives,” explains Elmos CEO Dr. Arne Schneider. “The sale of this wafer fab is an important structural alignment to our strategy, and over time, also brings new products and technologies to the Dortmund wafer fab and its workforce. We greatly appreciate ATREG’s long-term partnership and strong industry relationships that have enabled us to get to this successful outcome with Littelfuse.”

Click here to read our press release. Click here to read the Elmos press release.

ATREG FACILITATES SALE OF TSI’S 200MM ROSEVILLE FAB TO BOSCH

ATREG is pleased to have represented TSI Semiconductors in the sale of its operational automotive- and aerospace-qualified 200mm manufacturing facility based in Roseville, USA to Robert Bosch GmbH. The German technology company plans to acquire the Californian manufacturing assets of the U.S. chipmaker and invest $1.5 billion over the next few years in strategically important semiconductor business for electromobility, subject to regulatory approval.

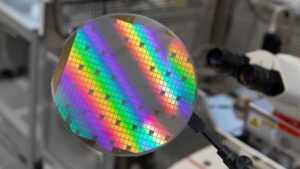

The Roseville manufacturing location which offers roughly 107,640 sq. ft (10,000 sq. m.) of cleanroom space will reinforce Bosch’s international semiconductor manufacturing network. Starting in 2026, following a retooling phase, Bosch will produce its first silicon carbide (SiC) chips on 200mm wafers in the Californian facility to meet global rising demand for the specialized chips, up to 30% a year on average. High demand comes mainly from the automotive sector to enable greater range and more efficient recharging for electric vehicles. With SiC chips, cars can use up to 50% less energy and increase their battery charge by six percent.

The Roseville manufacturing location which offers roughly 107,640 sq. ft (10,000 sq. m.) of cleanroom space will reinforce Bosch’s international semiconductor manufacturing network. Starting in 2026, following a retooling phase, Bosch will produce its first silicon carbide (SiC) chips on 200mm wafers in the Californian facility to meet global rising demand for the specialized chips, up to 30% a year on average. High demand comes mainly from the automotive sector to enable greater range and more efficient recharging for electric vehicles. With SiC chips, cars can use up to 50% less energy and increase their battery charge by six percent.

“TSI’s automotive-qualified trusted foundry is the perfect fit for Bosch to significantly expand its global portfolio of SiC semiconductors by the end of 2030 – unique technologies, a highly skilled workforce, and a flexible campus located near Silicon Valley, one of the world’s strongest semiconductor ecosystems,” explains Stephen Rothrock, Founder, President, and CEO of ATREG. “We are very pleased with this win-win outcome for both TSI Semiconductors and Bosch.”

Click here to read our press release. Click here to read Bosch’s press release.

STAFFING CHIP FABS – STRATEGIES FOR SUCCESS

By Stephen Rothrock, Founder, President & CEO, ATREG, Inc.

Since last year’s adoption of the CHIPS and Science Act aimed at bringing chip manufacturing back to U.S. shores, global semiconductor companies have announced a plethora of new U.S. greenfield fab builds worth billions of dollars. This is great news for the nation, but one that comes with a sizeable challenge – where will the industry find the 50,000 estimated qualified workers needed to staff these new plants? When it comes to the global skilled labor shortage in the semiconductor industry, there is no one-size-fits-all solution. Several measures, when combined, could augment human capital retention in our fabs, fill up the talent pipeline, and accelerate the recruitment of skilled workers over the coming months.

Since last year’s adoption of the CHIPS and Science Act aimed at bringing chip manufacturing back to U.S. shores, global semiconductor companies have announced a plethora of new U.S. greenfield fab builds worth billions of dollars. This is great news for the nation, but one that comes with a sizeable challenge – where will the industry find the 50,000 estimated qualified workers needed to staff these new plants? When it comes to the global skilled labor shortage in the semiconductor industry, there is no one-size-fits-all solution. Several measures, when combined, could augment human capital retention in our fabs, fill up the talent pipeline, and accelerate the recruitment of skilled workers over the coming months.

Click here to read the full contributed SEMI blog post.

NEXPERIA EXPLORING POTENTIAL SALE OF 200MM NEWPORT WAFER FAB, UK

Nexperia’s automotive-qualified 200mm fab located in Newport, South Wales offers nearly 40,000 sq. ft. of operational front-end cleanroom space and is currently producing a variety of analog and power technologies. The site is capable of manufacturing at geometries down to 0.18μm and is offering a potential supply agreement to support a new buyer’s transition. In addition to the 200mm facility, there is a unique former 150mm fab (currently used for final operations) that could be used as a flexible modular cleanroom space.

Nexperia’s automotive-qualified 200mm fab located in Newport, South Wales offers nearly 40,000 sq. ft. of operational front-end cleanroom space and is currently producing a variety of analog and power technologies. The site is capable of manufacturing at geometries down to 0.18μm and is offering a potential supply agreement to support a new buyer’s transition. In addition to the 200mm facility, there is a unique former 150mm fab (currently used for final operations) that could be used as a flexible modular cleanroom space.

Additional information on this facility is available under NDA. Please contact ATREG Vice President Annie Rothrock to learn more.

EXECUTIVE Q&A: JENS FABROWSKY, EVP, AUTOMOTIVE ELECTRONICS, BOSCH

ATREG recently sat down with Jens Knut Fabrowsky, Executive Vice President, Automotive Electronics at Robert Bosch GmbH, to discuss the company’s motivations behind the acquisition of the TSI Roseville, CA fab, what it means for the state of California, and his vision for the global silicon carbide (SiC) market.

ATREG recently sat down with Jens Knut Fabrowsky, Executive Vice President, Automotive Electronics at Robert Bosch GmbH, to discuss the company’s motivations behind the acquisition of the TSI Roseville, CA fab, what it means for the state of California, and his vision for the global silicon carbide (SiC) market.

Why did Bosch decide to establish a manufacturing base for SiC chips in the U.S.?

Bosch makes investments to seize global growth opportunities and strengthen its international presence. Growth in North America is a critical part of this strategy. We want to quickly position ourselves for the high demand on the SiC market. Bosch expects the share of electronics in vehicles to increase. In conjunction with the 2022 CHIPS and Science Act, it is currently an ideal time to invest in semiconductor manufacturing in the United States.

Why go for an acquisition strategy as opposed to a greenfield site, as you have for other expansions?

By purchasing an existing fab in an important market, we gain a time advantage compared to building a new fab. The location in Roseville has the right cleanroom space and specialist personnel to quickly set up another SiC mainstay.

What key factors made you select TSI Semiconductors’ Roseville fab? How significant were the location in CA or its highly qualified workforce?

California has a rich industrial history, workforce availability and is additionally attractive as an outbound region for expert assignments from across the globe. The Roseville location has been in existence since 1984 and has built up extensive experience in the design and production of semiconductors for automotive and industrial applications. We want to use this expertise to expand our semiconductor manufacturing.

Bosch has announced a $1.5 billion investment in the facility. How will that translate for the state of California and its population?

Bosch has announced a $1.5 billion investment in the facility. How will that translate for the state of California and its population?

Every dollar spent in high-tech equipment generates a multitude of employment and support services in surrounding areas. Besides the tool investment, we also bring the most advanced electrification technology and our corporate culture and community engagement to California.

U.S. Vice President Kamala Harris was quoted that Bosch’s investment will “put more electric vehicles on the road.” How will Bosch enhance the drive toward automotive electrification?

Short-term availability of SiC is crucial for a successful EV introduction. Compared to the technical alternatives such as IGBT, SiC offers significantly better performance leading to higher driving distance on the same battery charge.

What role did incentives (local, state, federal CHIPS) play into Bosch’s decision to invest in a U.S. facility?

The full scope of our planned investment will be heavily dependent on federal funding opportunities available via the CHIPS and Science Act as well as economic development opportunities within the state of California. We intend to apply for funding under the CHIPS and Science Act and have applied for the California Competes program in the state of California. The availability of appropriate subsidies to scale semiconductor manufacturing is essential. It also shows the commitment of the government to support the establishment of the technology and the ecosystem on a broader scale.

Finally, what are your predictions for the global SiC market and Bosch’s role within it?

SiC technology will quickly cover a wide range of applications from EVs to heavy industry, such as power distribution networks or trains. Bosch intends to be a major player, mastering the transformation from classical powertrain scenarios to a future electrified mobility provider.

About Jens Fabrowsky

Jens Knut Fabrowsky has been Executive Vice President, Automotive Electronics for Robert Bosch GmbH since April 2012. He started his career in 1999 as Director at Chassis Systems. In 2000, he joined Gasoline Systems and became Plant Manager in 2004. In 2007, he started with Starter Motors and Generators as Executive Vice President responsible for manufacturing. In 2012, he joined Bosch’s Automotive Electronics division in Reutlingen, Germany as Executive Vice President with responsibility for Electronic Control Units as well as Manufacturing. In 2017, he took responsibility for Semiconductor Components. Jens studied mechanical engineering and industrial engineering at the University of Stuttgart, Germany and the Technical University of Munich, Germany.

Jens Knut Fabrowsky has been Executive Vice President, Automotive Electronics for Robert Bosch GmbH since April 2012. He started his career in 1999 as Director at Chassis Systems. In 2000, he joined Gasoline Systems and became Plant Manager in 2004. In 2007, he started with Starter Motors and Generators as Executive Vice President responsible for manufacturing. In 2012, he joined Bosch’s Automotive Electronics division in Reutlingen, Germany as Executive Vice President with responsibility for Electronic Control Units as well as Manufacturing. In 2017, he took responsibility for Semiconductor Components. Jens studied mechanical engineering and industrial engineering at the University of Stuttgart, Germany and the Technical University of Munich, Germany.

ATREG PARTICIPATES IN GSA EUROPEAN PANEL

On June 14th, ATREG Vice President Annie Rothrock was invited to participate in the Diversity & Inclusion panel at the GSA European Executive Forum held in Munich, Germany. Moderated by Andrea Jehmlich, Managing Director at Accenture, other panelists included Maryam Rofougaran, CEO of Movandi, and Rebecca Dobson, Corporate Vice President EMEA at Cadence Design Systems.

On June 14th, ATREG Vice President Annie Rothrock was invited to participate in the Diversity & Inclusion panel at the GSA European Executive Forum held in Munich, Germany. Moderated by Andrea Jehmlich, Managing Director at Accenture, other panelists included Maryam Rofougaran, CEO of Movandi, and Rebecca Dobson, Corporate Vice President EMEA at Cadence Design Systems.

The panel discussed gender diversity and career opportunities for women in the global semiconductor industry, underpinned by research from the Semiconductor Gender Parity Study, which Accenture conducts annually with the Global Semiconductor Alliance. All panelists shared their career experiences, opinions, and hints for more inclusion and diversity in the semiconductor industry. In addition to acknowledging that there is a positive development in terms of women’s empowerment, all panelists agreed that there is still a long way to go to achieve gender equality in this segment and to bring more women into semiconductor leadership positions.

Two key aspects emerged from the discussion:

- The need to sensitize and inspire girls in school about technical subjects. Semiconductor companies need to find ways to create followers already at high school or even elementary school level.

- The need for C-level management buy-in and top-down implementation of the diversity and inclusion agenda to create an inclusive environment where everyone feels accepted and has equal opportunities to grow.

GSA FORUM: ATREG CEO INTERVIEW

ATREG Founder, President, and CEO Stephen Rothrock recently conducted an interview with the Global Semiconductor Alliance that was published in the Q2 edition of GSA Forum. In this article, Stephen provides an overview of the global semiconductor manufacturing asset market as well as valuable advice for global chip makers looking to divest or purchase wafer fabs in unstable global economic conditions plagued by geopolitical tensions. The piece touches on the following topics:

ATREG Founder, President, and CEO Stephen Rothrock recently conducted an interview with the Global Semiconductor Alliance that was published in the Q2 edition of GSA Forum. In this article, Stephen provides an overview of the global semiconductor manufacturing asset market as well as valuable advice for global chip makers looking to divest or purchase wafer fabs in unstable global economic conditions plagued by geopolitical tensions. The piece touches on the following topics:

- The lessons drawn from past global wafer fab transactions

- How the U.S. CHIPS Act will help bring silicon chip manufacturing back to U.S. shores

- The big winners of the U.S. CHIPS Act funding

- The current state of legacy / brownfield wafer fabs in the U.S.

- The strategic features and factors that make brownfield fabs valuable

- How new greenfield fabs coming online over the coming months will affect U.S. semiconductor capacity

- The strategic benefits of selling and buying fabs for chip makers

Click here to read the full article.

![]() The ATREG team looks forward to reconnecting with you at SEMICON West from July 11th to 13th in San Francisco, CA. Please email us to set up an appointment with one of our fab transaction advisors at the event to discuss your infrastructure-rich semiconductor manufacturing asset needs. No matter your requirements – brownfield or greenfield, we can assist your company with its global manufacturing strategy. The team will also attend these other industry conferences over the coming months. We hope to see you there!

The ATREG team looks forward to reconnecting with you at SEMICON West from July 11th to 13th in San Francisco, CA. Please email us to set up an appointment with one of our fab transaction advisors at the event to discuss your infrastructure-rich semiconductor manufacturing asset needs. No matter your requirements – brownfield or greenfield, we can assist your company with its global manufacturing strategy. The team will also attend these other industry conferences over the coming months. We hope to see you there!

- Goldman Sachs Communacopia & Technology Conference, September 5-8, San Francisco, USA

- GSA U.S. Executive Forum, September 14, Menlo Park, USA

- GSA WLI WISH Conference, October 12, San Jose, USA

- International Trade Partners Conference (ITPC), October 29 –November 1, Hawaii, USA