VISHAY TO ACQUIRE NEXPERIA NEWPORT, UK FAB

ATREG is pleased to announce that it successfully represented Dutch semiconductor company Nexperia B.V. in the sale of its 200mm automotive certified Newport, South Wales, UK fab to U.S. company Vishay Intertechnology, Inc. for $177 million in cash. With headquarters in Malvern, PA, Vishay manufactures one of the world’s largest portfolios of discrete semiconductors and passive electronic components that are essential to innovative designs in the automotive, industrial, computing, consumer, telecommunications, military, aerospace, and medical markets.

Located on 28 acres, the Newport wafer fab is the UK’s largest semiconductor manufacturing facility and primarily supplies automotive markets. Transaction closing is expected to occur in the first quarter of 2024 subject to UK government review.

Located on 28 acres, the Newport wafer fab is the UK’s largest semiconductor manufacturing facility and primarily supplies automotive markets. Transaction closing is expected to occur in the first quarter of 2024 subject to UK government review.

“Over the past 18 months, we have seen an uptick in global demand for compound semiconductor-capable brownfield fabs,” explains Stephen Rothrock, President and CEO of ATREG. “Vishay’s acquisition of Nexperia’s Newport, UK fab will ensure the long-term growth of the site and the safeguard of hundreds of local jobs.”

Click here to read Nexperia’s press release. Click here to read Vishay’s press release.

EXECUTIVE Q&A WITH LAITH ALTIMIME, PRESIDENT, SEMI EUROPE

ATREG recently sat down with Laith Altimime to discuss the latest developments in the European semiconductor ecosystem. In this interview, the President of SEMI Europe shares valuable insights on the European CHIPS Act, supply chain challenges, the local talent shortage, the role of silicon carbide in the automotive sector’s transition to electric vehicles, as well as Europe’s manufacturing aspirations on the global semiconductor stage.

The recent passing of the long expected European CHIPS Act is a true win for your region. In your opinion, what will be its biggest impact / how will it strengthen Europe’s semiconductor manufacturing leadership?

The recent passing of the long expected European CHIPS Act is a true win for your region. In your opinion, what will be its biggest impact / how will it strengthen Europe’s semiconductor manufacturing leadership?

A diverse range of new disruptions are driving exponential growth, underpinned by artificial intelligence (AI) doubling the industry to $1 trillion by 2030. This provides tremendous opportunities as well as challenges, e.g. climate, geopolitics, talent, and supply chain disruptions. The European CHIPS Act which has been implemented as of September 2023 is instrumental to strengthen Europe’s leadership and competitiveness in the global value chain providing a more resilient ecosystem in Europe.

Where do you see Europe’s role in providing legacy products as opposed to leading-edge products on the global stage?

- With the successful launch of the EU CHIPS Act, Europe is targeting to increase its global market share from 8% today to 20% by 2030.

- Europe is strategically positioned in the global value chain with SoA RTOs, imec, Leti, FhG, etc. as well as world leaders in materials (Merck, BASF, Air Liquide and Equipment, ASML, EVG, Besi, ASM), world-leading IDMs (Infineon, Bosch, ST, NXP), and companies at system level in automotive, medical, SMART manufacturing, and industrial IoT.

- The semiconductor industry faces several headwinds – geopolitics, climate, talent, and supply chain disruptions which cannot be overcome by one country or one company.

- SEMI’s differentiated value is its global footprint as the global industry association is well positioned to connect governments, decision makers, and industry leaders to connect, collaborate, and innovate to advance our industry towards $1 trillion by 2030.

- As we have seen in the U.S. and Germany with Wolfspeed, ST and GF, Intel, Taiwan, and Europe with TSMC (ESMC), collaborations building on each other’s strengths to accelerate sustainable technology solutions enabling the industry’s $1 trillion exponential growth.

What post-Covid supply chain issues remain for Europe as a region and what measures are being put in place to solve them?

The semiconductor industry faces many internal challenges, from materials handling to recycling and process improvements. It also faces growing external challenges such as geopolitics tied to resource availability and trade. Geopolitically induced disruptions such as export control, the Russia-Ukraine war, and the ongoing Israel-Hamas conflict continue to impact the supply chain. Deglobalization can lead to the fragmentation of supply chains, making it difficult for semiconductor companies to source components and raw materials from multiple countries. However, the overall semiconductor market continues to grow rapidly.

Silicon carbide production is revolutionizing the global semiconductor industry. How will SiC reinforce European car makers’ international leadership in EVs e.g.?

Silicon carbide production is revolutionizing the global semiconductor industry. How will SiC reinforce European car makers’ international leadership in EVs e.g.?

SiC, a wide-bandgap semiconductor, is a key technology accelerator for electric vehicles. Automotive and industrial customers around the world are adopting SiC to enhance the performance of their systems. In line with carbon-emission–reduction goals, EV adoption is surging, the electrification of vehicles being a necessary step for achieving carbon neutrality. Over the past couple of years and under the European CHIPS Act, we have seen tremendous investments across Europe – STMicroelectronics invested in its manufacturing facilities and expanded its partnership with Soitec on SiC substrate manufacturing technology. Soitec also opened a new plant in Bernin, positioning SmartSiC™ as a future electric vehicle standard.

Sustained demand for SiC wafers is such that IDMs such as STMicroelectronics, Infineon, and onsemi adjusted their strategies to meet the requirements of automotive OEMs. In addition to the recent joint-venture Wolfspeed and ZF are planning, the partnership also includes a joint R&D center in Germany to accelerate global silicon carbide systems. All these investments are key towards strengthening Europe’s supply chain resilience and supporting the European Green Deal as well as the strategic goals for Europe’s sustainable digital future.

The skilled labor shortage in our industry can be felt all over the globe. How will Europe solve its talent shortage to staff all of the new upcoming wafer fabs? What kind of programs have you put in place locally?

- SEMI has recently launched the European Chips Skills Alliance to tackle this very issue. Stemming from the Pact for Skills for Microelectronics, its aim is to connect every facet of the skills pipeline to address the skills gap from all angles.

- In the mid- to long term, it will be key to attract more pupils to go into STEM education and to showcase the attractiveness of the microelectronics sector. This also means that companies need to proactively interact with schools.

Retention, up- and re-skilling will become even more important which will require a close cooperation between companies, regional and national government actors, as well as education providers. For example, the European Chips Skills Academy (METIS 2.0) project will connect industry and education to develop targeted and freely accessible training material that covers some of the most crucial needs such as knowledge on cybersecurity and AI.

Retention, up- and re-skilling will become even more important which will require a close cooperation between companies, regional and national government actors, as well as education providers. For example, the European Chips Skills Academy (METIS 2.0) project will connect industry and education to develop targeted and freely accessible training material that covers some of the most crucial needs such as knowledge on cybersecurity and AI.- SEMI Europe has also launched a career web site to connect job seekers with the right position that match their skills and interests. Other initiatives include:

- SEMI High Tech U to help motivate high school students to explore careers in microelectronics.

- “Chip In”, a documentary highlighting careers in microelectronics.

- 20 Under 30 awards to recognize young talent in the industry.

- Flash mentoring during SEMI events and the SEMI leadership accelerator to support young professionals in reaching career goals.

- On a global level, SEMI launched SEMI University, the new global online learning platform created by SEMI to fast-track semiconductor skills.

There is sometimes a misconception that everyone working in the semiconductor industry is an engineer or a physicist or any other role that would require a specialized degree or even a PhD. In fact, reskilling talent to be able to operate fabs may be a promising way to channel workers from a shrinking industry into one which is rapidly expanding.

To conclude, if you had one piece of advice to give global chip makers with regards to being successful in the European market, what would it be?

Collaboration. There are several headwinds for the global semiconductor industry to reach the $1 trillion and for Europe to achieve its goal of 20% of the global market share by 2030. Collaboration at European and global level is instrumental to mitigate these challenges and keep the industry’s exponential growth on target. On top of bringing in skilled talent from outside of the European Union, we need to continue making Europe a more attractive and competitive place to live and work. We need to capitalize on skilled migrants across Europe.

About Laith Altimime

As President of SEMI Europe, Laith leads SEMI’s activities in Europe, the Middle East, and Africa. He has P&L responsibility as well as ownership of all the European region’s programs and events, including SEMICON Europa. Laith is responsible for establishing industry standards, advocacy, community development, expositions, and programs. He provides support and services to SEMI members worldwide that have supply chain interests in Europe. He manages and nurtures relationships with SEMI members in the region and globally, as well as with local associations and constituents in industry, government, and academia. Laith has more than 30 years of international experience in the semiconductor industry. Prior to joining SEMI in 2015, he held senior leadership positions at NEC, KLA-Tencor, Infineon, Qimonda, and imec. Laith holds an MSc from Heriot-Watt University in Scotland, UK.

As President of SEMI Europe, Laith leads SEMI’s activities in Europe, the Middle East, and Africa. He has P&L responsibility as well as ownership of all the European region’s programs and events, including SEMICON Europa. Laith is responsible for establishing industry standards, advocacy, community development, expositions, and programs. He provides support and services to SEMI members worldwide that have supply chain interests in Europe. He manages and nurtures relationships with SEMI members in the region and globally, as well as with local associations and constituents in industry, government, and academia. Laith has more than 30 years of international experience in the semiconductor industry. Prior to joining SEMI in 2015, he held senior leadership positions at NEC, KLA-Tencor, Infineon, Qimonda, and imec. Laith holds an MSc from Heriot-Watt University in Scotland, UK.

SEMICON EUROPA WOLFSPEED FIRESIDE CHAT

It was a pleasure to reconnect with the global semiconductor industry at another successful SEMICON Europa in Munich, Germany last month. Our sincere thanks to the SEMI Europe team for inviting ATREG CEO Stephen Rothrock to host a fireside chat with Wolfspeed CFO Neill Reynolds on November 16th.

It was a pleasure to reconnect with the global semiconductor industry at another successful SEMICON Europa in Munich, Germany last month. Our sincere thanks to the SEMI Europe team for inviting ATREG CEO Stephen Rothrock to host a fireside chat with Wolfspeed CFO Neill Reynolds on November 16th.

The discussion focused on the factors that make Wolfspeed’s global greenfield strategy so successful as the global semiconductor manufacturing company – from building the world’s first state-of-the-art 200mm silicon carbide (SiC) greenfield fab in record time during the Covid pandemic at the Marcy Nanocenter site near Utica, NY to addressing the industry’s latest challenges, including the global skilled labor shortage, increasing competition in the SiC field, the supply and demand disconnect, and the lack of supporting infrastructure in greenfield semiconductor ecosystems. Thank you to Neill for providing us with such valuable industry insights!

What’s in store for silicon carbide (SiC) and gallium nitride (GaN) in 2024? This is the topic of ATREG President and CEO Stephen Rothrock‘s latest contributed forecast column entitled 2024 – The Springboard for Compound Semiconductors? and published in the November / December issue of Semiconductor Digest.

What’s in store for silicon carbide (SiC) and gallium nitride (GaN) in 2024? This is the topic of ATREG President and CEO Stephen Rothrock‘s latest contributed forecast column entitled 2024 – The Springboard for Compound Semiconductors? and published in the November / December issue of Semiconductor Digest.

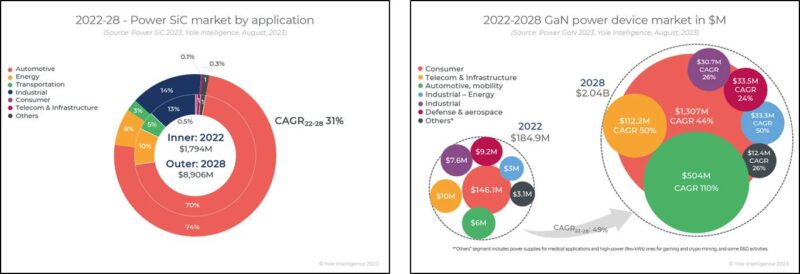

While forecasts vary, most semiconductor analysts agree that silicon carbide (SiC) and gallium nitride (GaN) will capture about 30% of the global power semiconductor market by 2027. According to Yole Intelligence, the global SiC market alone will grow to nearly $9 billion by 2028 while the global GaN market is expected to represent over 6% of the power electronics market by 2028, reaching $2.04 billion.

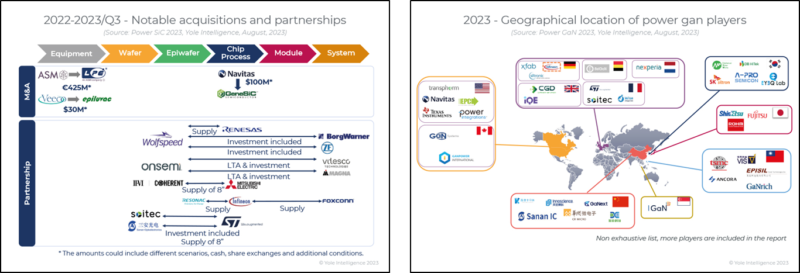

With SEMI projecting global wafer shipments to bounce back by 8.5% in 2024, the astronomical growth of SiC and GaN power devices could reshape the global manufacturing fab asset landscape as we know it. Supported by a global investment frenzy fueled by local CHIPS Act funding, more and more chip makers are building brand-new wafer fabs, installing pilot lines, striking alliances with partners, or acquiring other companies to keep up with the global compound semiconductor race.

After building the world’s first 200mm SiC fab in Mohawk Valley, NY in record time during the Covid pandemic, Wolfspeed has since then set its sights on Germany to build its European equivalent with partner ZF. Infineon recently finalized its acquisition of Canadian company GaN Systems for US$830 million, which will significantly accelerate its GaN roadmap. In August, Bosch completed the acquisition of TSI Semiconductors’ operational 200mm fab in Roseville, CA destined to produce SiC chips on 200mm wafers. Attracting one of Europe’s largest manufacturers to U.S. soil who has only ever produced front-end chips in Germany is a massive win for the U.S. semiconductor industry as Bosch plans to invest $1.5 billion in the Roseville site over the next few years. ATREG facilitated both Wolfspeed and Bosch transactions.

STMicroelectronics has installed an eight-inch GaN pilot line in Tours, France while Nexperia is developing its e-mode technology, and ROHM entered the power GaN market in 2022. Despite being a relative latecomer to the power SiC device market, onsemi’s 2023 Q1 results suggest it is on track to achieve ambitious revenues of $1 billion in 2023.

In the field of SiC crystal growth, China received recognition from international IDMs in 2013, leading to a significant increase in production capacity by Chinese manufacturers. Previously, SiC materials from China accounted for only 5% of the global market. More than half of the world’s SiC wafers might come from China in 2024. Bosch, Infineon, and STMicroelectronics have all signed contracts and formed joint ventures with companies like SICC, TankeBlue, and San’an, which can be seen as a guarantee of China’s strength and quality.

Looking to the future, we expect 2024 to be a springboard for SiC and GaN M&A and partnerships, especially IDMs acquiring fabless companies, and fabless companies investing in foundries and epihouses to secure production capacity.

Click here to view the full article on page 22 of the online edition of Semiconductor Digest.

As 2023 comes to a close, the ATREG team is very grateful and thankful for the continued loyalty and support of its valued clients and partners. This year again for the holidays, we will be making donations on their behalf to the following local and international non-profit organizations:

As 2023 comes to a close, the ATREG team is very grateful and thankful for the continued loyalty and support of its valued clients and partners. This year again for the holidays, we will be making donations on their behalf to the following local and international non-profit organizations:

- L’Arche International – An international federation dedicated to the creation and growth of homes, programs, and support networks for people with and without intellectual disabilities to live mutual relationships, share daily life, and build a community together.

- The Solutions Project – An organization that funds and amplifies climate justice solutions created by Black, Indigenous, immigrant, women, and communities of color building an equitable world.

- Global Partnerships – An international impact investor with the mission to expand opportunity for people living in poverty via micro-financing.

- The Homeless Project / Chief Seattle Club – An organization dedicated to physically and spiritually supporting American Indian and Alaska Native people in the Seattle Area.

Wishing you and yours health, happiness, and success in 2024!

The ATREG Team

The ATREG team looks forward to reconnecting with you in the new year at SEMI’s annual Industry Strategy Symposium (ISS) to be held from January 7 to 10 in Half Moon Bay, CA. Need to dispose of or acquire a brownfield fab or cleanroom? Looking for a brand-new greenfield building location or extra loading capacity? ATREG can help! Please email us to set up an appointment with one of our fab transaction advisors at the event and discuss your global infrastructure-rich manufacturing asset needs.

The ATREG team looks forward to reconnecting with you in the new year at SEMI’s annual Industry Strategy Symposium (ISS) to be held from January 7 to 10 in Half Moon Bay, CA. Need to dispose of or acquire a brownfield fab or cleanroom? Looking for a brand-new greenfield building location or extra loading capacity? ATREG can help! Please email us to set up an appointment with one of our fab transaction advisors at the event and discuss your global infrastructure-rich manufacturing asset needs.

Click here to register for the event.