REFLECTIONS ON 20 YEARS OF GLOBAL FAB TRANSACTIONS

By Stephen Rothrock, Founder, President & CEO, ATREG, Inc.

Over the past 50 years, the semiconductor industry has faced its fair share of difficult challenges. The COVID-19 pandemic the world is currently experiencing has caused the worst downturn since the financial crisis of 2008, devastating global economies. And yet, the semiconductor industry has repeatedly shown incredible resilience in the face of adversity. Despite the pandemic, the market has not experienced such a dramatic upturn since 2003. As factories temporarily suspend activity while waiting for their semiconductor components supply, the sudden rise in chip demand combined with a global supply shortage means that supply is no longer a given. The new market upturn breaks open the fundamental flaws and risks of manufacturing concentration and outsourcing.

Over the past 50 years, the semiconductor industry has faced its fair share of difficult challenges. The COVID-19 pandemic the world is currently experiencing has caused the worst downturn since the financial crisis of 2008, devastating global economies. And yet, the semiconductor industry has repeatedly shown incredible resilience in the face of adversity. Despite the pandemic, the market has not experienced such a dramatic upturn since 2003. As factories temporarily suspend activity while waiting for their semiconductor components supply, the sudden rise in chip demand combined with a global supply shortage means that supply is no longer a given. The new market upturn breaks open the fundamental flaws and risks of manufacturing concentration and outsourcing.

At a time when the world is precariously dependent on Taiwan for semiconductors, how can the global supply chain forecast, manage, and plan for such sudden shifts in the future? Now more than ever before, advanced technology companies need to keep the finger on the pulse of supply and demand to successfully inform their strategic manufacturing decisions and remain agile to keep their businesses successful. In this article, we thought we would provide a few insights resulting from the past 20 years facilitating semiconductor manufacturing asset transactions, including semiconductor fabs, cleanroom facilities, and technology campuses in North America, Europe, and Asia.

GLOBAL OPERATIONAL FAB TRENDS

Despite increasing industry consolidation, fewer fab transactions took place in 2020 as companies focused on the COVID-19 pandemic. We anticipate an uptick in fab-related transactions in 2021 as global vaccination efforts get under way and global travel restrictions gradually ease.

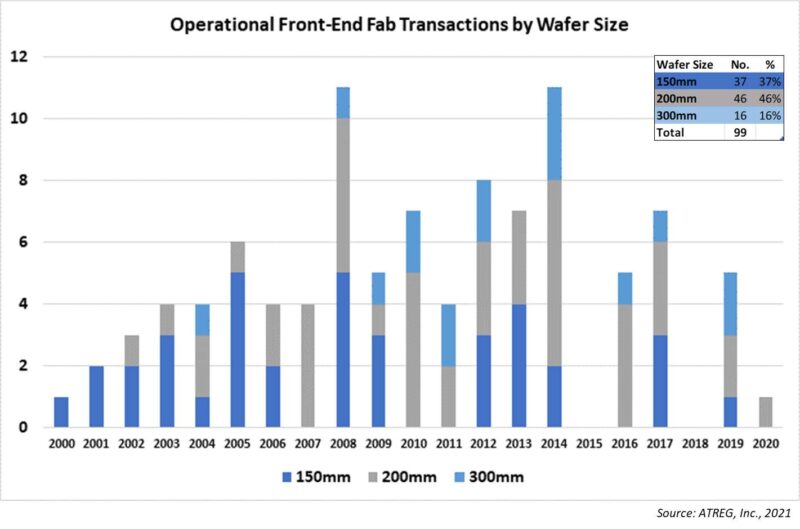

- The need for 200mm capacity has remained steady through the last two decades, making up nearly 50% of all transactions

- Demand for 150mm fabs has fallen off significantly since 2014

- While they represent a low overall percentage of transactions since 2000, 300mm fabs will likely trade more frequently as technology matures and fabs age

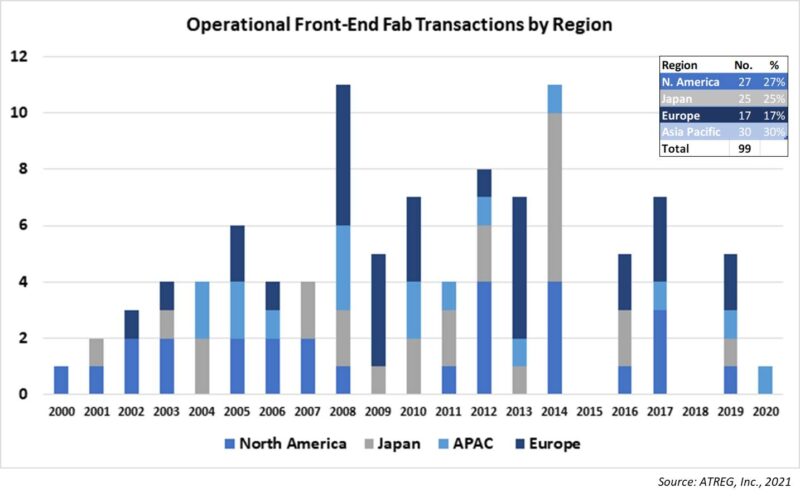

- Japan has seen a precipitous decline in the number of operational fabs transacted, falling off sharply since 2015

- The resurgence in interest in U.S. manufacturing isn’t reflected in the graphic above. We will see a significant uptick in operational fab transactions in the next few years as companies look to mitigate risk, be located nearer their customers, and take advantage of increased regional and federal incentives

- The U.S. will also see a number of new greenfield fabs built as companies look to expand 300mm capacity

SELECTING A TRUSTWORTHY ADVISOR

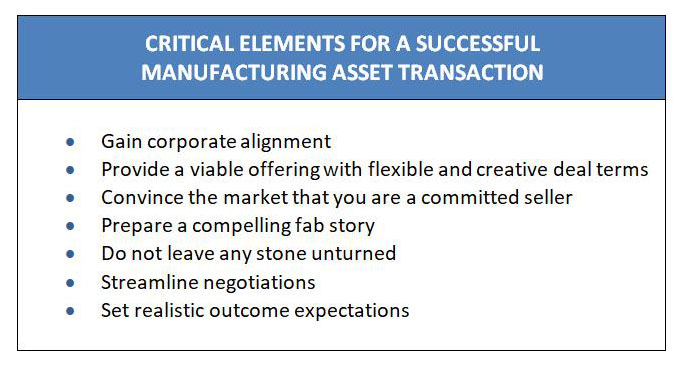

Divesting or acquiring an infrastructure-rich manufacturing asset is a complex and risky endeavor for a company to successfully handle on its own. They should consider partnering with an experienced advisor who:

Divesting or acquiring an infrastructure-rich manufacturing asset is a complex and risky endeavor for a company to successfully handle on its own. They should consider partnering with an experienced advisor who:

- Acts as an unbiased third-party representing the client’s best interests

- Offers a clear, neutral, and impartial process providing options that are not colored by their own financial interests

- Intimately knows the factors that are important to operational fab buyers

- Is familiar with legislation governing the industry, permitting and environmental issues, local and national incentives, and unionized labor force issues

- Needs to be able to handle a transaction’s multiple facets – land, buildings, intellectual property (IP), equipment and tool lines, as well as business unit elements such as multi-year supply agreements, lease-backs, and workforce issues

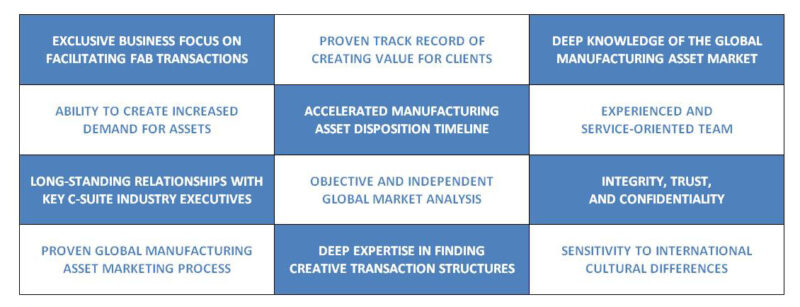

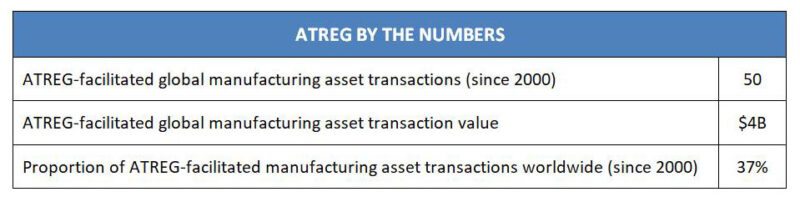

ATREG was founded in 2000 to do just that – to attract the right kind of buyers and position clients for long-term growth. To ensure a successful, timely transaction, an advising partner should offer the following characteristics:

ATREG is the only firm in the world focused exclusively on advising advanced technology companies on the acquisition and divestment of global infrastructure-rich semiconductor manufacturing assets.

Companies thinking about divesting or acquiring assets as part of their global manufacturing strategy should now take full advantage of the current resurgence in semiconductor chip demand driven by the COVID-19 vaccine roll-out and the improved economic projections for 2021 and 2022. In early March 2021, semiconductor industry analyst firm IC Insights actually raised its 2021 IC market growth forecast from 12% to 19% which is very encouraging for our industry. Under current geo-political tensions, new domestic manufacturing needs are emerging in the U.S. as well as the European Union and driving the push for EU / U.S. semiconductor initiatives and federal legislative support, including attractive government incentives fostering technology investment that companies can take advantage of in many parts of the world.

The ATREG team remains at your disposal to help your company navigate the challenges ahead. Don’t hesitate to email me to set up a global market update web conference. We look forward to being of assistance in the future!

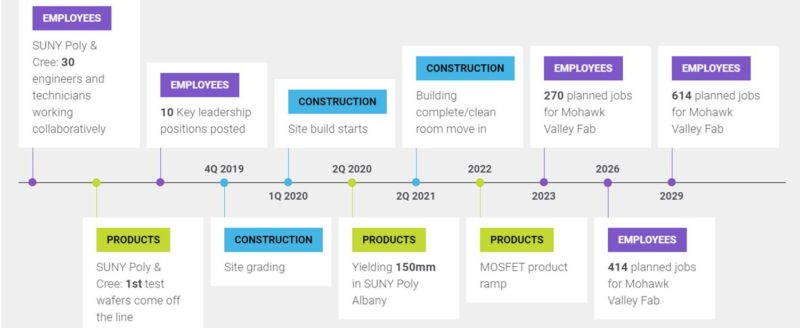

CREE | WOLFSPEED UPSTATE NY FAB CONSTRUCTION UPDATE

A lot has happened at the Marcy Nanocenter since our last update in Q3 2020! The construction of the world’s largest silicon carbide (SiC) device manufacturing facility is advancing at warp speed. The Cree | Wolfspeed fab is on schedule to start production in 2022 with 80% of the staff being engineering and technical.

Here is an overview of the construction timeline:

On October 29th, a “topping off” ceremony was held at the brand-new wafer fabrication facility. Empire State Development‘s Acting Commissioner, President and CEO Eric Gertler, alongside executive members from Cree | Wolfspeed, Oneida County, and Empire State Development joined distinguished guests in commemorating the placement of the final steel beam atop the new fab.

Other recent developments include the completion of the fab’s enclosure, the energization of the customer substation allowing Mohawk Valley EDGE to service Cree | Wolfspeed and future customers, as well as a 150,000 sq. ft. plot adjacent to the Marcy Nanocenter site called The Farmer Parcel being programmed for supply chain companies to settle next to Cree | Wolfspeed.

This construction of the automotive-qualified and 200mm-capable power and radio frequency facility is happening as the U.S. takes strategic steps to onshore electronics manufacturing. In early January, the U.S. Congress passed the annual policy law that guides the U.S. Defense Department. Tucked away inside the National Defense Authorization Act of 2021 (NDAA) are provisions that supporters hope will lead to a resurgence in chip manufacturing in the United States. The provisions include authorization for what could be billions of dollars of financial incentives for construction or modernization of facilities “relating to the fabrication, assembly, testing, advanced packaging, or advanced research and development of semiconductors.”

For more construction updates, please visit the Cree | Wolfspeed web site.

For the past three years, industry publication Semiconductor Packaging News has invited our Founder, President, and CEO Stephen Rothrock to contribute a ViewPoint in the new year. In case you missed this year’s contributed article published on January 22, here is the full column below.

For the past three years, industry publication Semiconductor Packaging News has invited our Founder, President, and CEO Stephen Rothrock to contribute a ViewPoint in the new year. In case you missed this year’s contributed article published on January 22, here is the full column below.

COVID-19: Lessons learned for a better tomorrow

The COVID-19 pandemic has had a devastating effect on our health and economies. As mass vaccination campaigns get underway around the globe, 2021 will not only be a time for hope and recovery, but also for reflection — what positive lessons can we learn from such an ordeal? Adversity brings opportunity, and despite the trail of destruction it has left in its wake, COVID-19 will have initiated a legacy of positive trends that we, as humankind, should take advantage of to make our future world a better place.

The pandemic has accelerated digital transformation on a global scale, which in turn has led to an increased focus on social justice, health, climate change, as well as cyber security; all this has substantially been enabled by semiconductor technology at the outset.

Global lockdowns reducing human pollution revived consumer awareness about the environment and increased demand for green energy technologies, such as electric vehicles, solar, and wind. Companies find greener ways to produce energy and countries have put deadlines in place by which they will no longer allow the sale of the internal combustion engine.

The European Union is pushing to dedicate 30% of its stimulus package to green energy. And when it comes to the semiconductor industry, it has also shown the increasing importance of supply chain resilience. Although more challenging due to the pandemic, operational fab sales, M&A transactions, and company integrations continued worldwide.

New processes developed and dictated by the COVID-19 pandemic are here to stay. With imposed travel restrictions, companies have realized that business with external parties can be conducted just as successfully remotely through video conferencing. From a product standpoint, and with more people working from home, the huge demand for laptops, iPads, and displays will continue. And employees currently working from home may well elect to continue doing so four or five days a week post-pandemic to eliminate long commutes and be more productive. With the expansion of 5G and other networking technologies, companies can hire talent remotely and students can learn online.

In this new normal, a successful company will be the one that remains cognizant of the transformations currently taking place and how those changes will impact their business and employees. This represents a tremendous opportunity for all of us to do better for ourselves, others, and our environment.