SOLD: ALLEGRO MICROSYSTEMS CLEANROOM, THAILAND

ATREG is pleased to announce that it has successfully facilitated the disposition of Allegro MicroSystems’ manufacturing facility in Thailand for approximately $30 million before fees and expenses. The leading global designer, developer, fabless manufacturer, and marketer of sensor integrated circuits and application-specific analog power ICs enabling emerging technologies in the automotive and industrial markets has entered into a definitive agreement with an undisclosed third-party.

ATREG is pleased to announce that it has successfully facilitated the disposition of Allegro MicroSystems’ manufacturing facility in Thailand for approximately $30 million before fees and expenses. The leading global designer, developer, fabless manufacturer, and marketer of sensor integrated circuits and application-specific analog power ICs enabling emerging technologies in the automotive and industrial markets has entered into a definitive agreement with an undisclosed third-party.

This disposition is an important milestone in the execution of Allegro’s manufacturing transformation to streamline back-end operations and enhance gross margin. Allegro expects to close the transaction within the calendar year, subject to governmental approvals in Thailand and customary closing conditions.

Allegro had previously announced its plans for back-end facility consolidation as part of a multi-year strategic transformation to optimize the company’s manufacturing footprint and reduce fixed costs. Last quarter, the company shared that it had successfully transferred production from AMTC into its Manila, Philippines facility, one quarter earlier than initially planned. The AMTC facility closure and sale will complete the company’s transition to a fabless, asset-lite manufacturing model.

Click here to read Allegro MicroSystems’ press release for more information.

USEFUL CONSIDERATIONS WHEN ACQUIRING A FAB

For advanced technology companies, purchasing an infrastructure-rich semiconductor fab or cleanroom manufacturing facility anywhere in the world can be a complex, cumbersome, lengthy, time-consuming, and costly endeavor if handled internally without proper guidance and knowledge. The selection of a fab site is a crucial part of a sound manufacturing strategy for any advanced technology company. It should therefore be conducted with the utmost care after completing extensive global research to ensure the company’s fab specifications are fully met. So how do you find the fab that will best deliver on your manufacturing strategy and meet your specific production needs? Here are some useful considerations to take into account when looking to acquire a fab.

For advanced technology companies, purchasing an infrastructure-rich semiconductor fab or cleanroom manufacturing facility anywhere in the world can be a complex, cumbersome, lengthy, time-consuming, and costly endeavor if handled internally without proper guidance and knowledge. The selection of a fab site is a crucial part of a sound manufacturing strategy for any advanced technology company. It should therefore be conducted with the utmost care after completing extensive global research to ensure the company’s fab specifications are fully met. So how do you find the fab that will best deliver on your manufacturing strategy and meet your specific production needs? Here are some useful considerations to take into account when looking to acquire a fab.

- Operational fab or fab shell – A sound, operational fab with an existing tool line, even if it needs to be upgraded, may be a better choice for your company in the long run to ensure faster time-to-market.

- Geographic location – In light of ongoing trade wars, rising tariffs and labor costs, as well as copyright infringement, more and more IC manufacturers choose to pull away from China and bring chip production closer to their customers in the U.S. and Europe who is looking to develop its own local supply chain.

- Capacity – Consider fab opportunities that come with a supply contract that can be easily and fairly negotiated between both parties to ensure continuity of supply for several years. Privilege facilities that offer expansion possibilities, so you can grow your production as needed over time.

- Intellectual property – Acquiring a fab from a company offering proprietary IP as part of the transaction can be a great asset if it fits within your global manufacturing strategy.

- Workforce – Consider reemploying the fab’s workforce who already brings years of facility operating experience. But don’t underestimate the local culture if the fab is located overseas. Understand it well to get the most out of your local workforce.

- Local talent – Make sure that the fab is located in a favorable academic and R&D ecosystem that will provide a regular and diversified pool of future engineering and business recruits.

- Purchase price – Don’t get too hung up on the fab’s purchase price. Make sure you evaluate the opportunity cost, know all assumed liabilities, and understand all operating expenses. Remember also that the current shortage of particular manufacturing space, especially 200mm, means cleanrooms and operational fabs will sell at a premium.

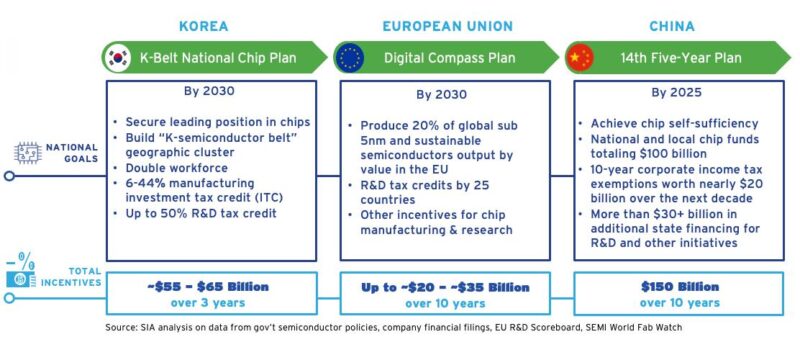

- Local government incentives – As the global chip war heats up and the chip shortage increases, governments around the world are offering semiconductor manufacturers lavish subsidies and perks to attract companies to their shores. To find out more about government incentives available in North American, Europe, or Asia, please email us.

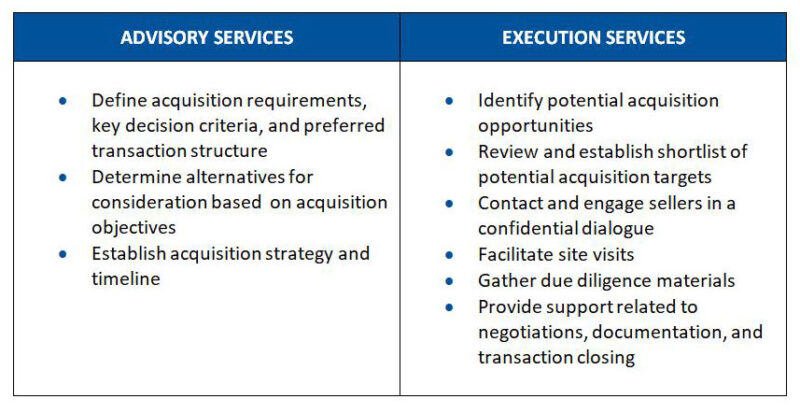

With semiconductor analyst firms such as IC Insights raising their 2021 worldwide IC market forecast to +24% and expecting the global IC market to exceed $500 billion for the first time, advanced technology companies need to prepare for the future to meet that demand. ATREG has worked with firms seeking to augment existing manufacturing capacity and capabilities by strategically evaluating manufacturing purchase opportunities. For example, we have helped Philips acquire Maxim’s San Antonio, TX operational 200mm fab in November 2003 and Atmel purchase Maxim’s Irving, TX operational 200mm fab in April 2007. Should your company look for a trusted partner to assist with the search for a suitable infrastructure-rich manufacturing asset anywhere in the world, here is how ATREG can help:

To schedule a web conference to discuss your specific fab or cleanroom acquisition needs, please email ATREG Vice President Annie Rothrock.

UPCOMING ATREG SPEAKING ENGAGEMENTS

ATREG Founder, President, and CEO Stephen Rothrock returns to the speaking circuit this year to present at the following events:

ATREG Founder, President, and CEO Stephen Rothrock returns to the speaking circuit this year to present at the following events:

- September 8 – MEPTEC‘s Semiconductor Industry Speaker Series webinar

- October 11 to 14 – IMAPS’ 54thInternational Symposium on Microelectronics to be being held in person at the Town and Country Resort in San Diego, CA

A lot has changed since last year – learning to live with COVID, a new U.S. administration, a chip boom, a supply shortage, 200mm fabs in even higher demand, Europe boosting its own semiconductor manufacturing, competing global government incentives for greenfield fab construction, precarious dependence on Taiwan, and increased disengagement from China due to global tariffs and trade wars. Steve will provide some insights on how the current market upturn is likely to evolve over the coming year and how it will impact the OSAT market as well as IDMs.

Click here to register for the MEPTEC event. We hope to connect with you there!